Vertical SaaS has had an incredible run over the past decade. The increasing number of public vertical SaaS winners with multiple billions, such as in life sciences (Veeva), construction (Procore), restaurants (Toast), and banking (nCino), illustrates how cloud-based and mobile software tailored to specific industries can become giant businesses. Vertical software not only appeals to investors due to its attractive business model but also its potential to revolutionize traditionally labor-intensive industries.

With continued digitalization, shifts in buying behavior, API improvements, data availability, and ongoing innovation with LLMs, we are entering a new era of vertical SaaS. Industries and technology are continuously evolving, creating opportunities for new vertical SaaS companies. Changes in user behavior and advances in technology have paved the way for more opportunities than previously anticipated, even within the span of the past decade. Let’s look at the key lessons from the prior decade of vertical SaaS, and what trends will shape this new era.

Key takeaways from the last era of vertical SaaS:

There are a number of factors that led to the creation of giant vertical SaaS companies, such as operating in fragmented markets, founders with significant domain experience, capital efficiency in the operating model, and others:

Market Fragmentation → Many vertical SaaS companies that achieve large scale started in highly fragmented markets with a high degree of buyers and sellers. Often, no single player owns a significant portion of the market. This creates an opportunity for new vertical SaaS startups to be the connective glue tying together the market with less competition from incumbents. We have seen this strategy succeed with restaurants (Toast), dental shops (Archy), and many others. Frequently, the market consists of numerous SMBs or "mom and pop" shops that lack digital technology and are eager to embrace vertical-specific digitization.

Founder-Domain Expertise → Founders who have experience in a particular domain have a clear advantage in industries that have unique complexities. They have a deeper understanding of their customers, know the particular nuances of their industry, and have contacts that can become early adopters of their software. Typically, founders of vertical SaaS companies have personally experienced the pain points that led them to start their own business. For example, the founders of ServiceTitan had grown up in a world of plumbing, as the children of plumbers.

Capital Efficiency → One hallmark of a successful vertical SaaS company is capital efficiency. Since a concentrated number of customers within a specific vertical often have similar wants and needs, they are generally more uniform than customers of a horizontal SaaS company. This allows the team to develop a simplified product. Some studies have shown on average, horizontal SaaS companies spend 15-20% more on sales and marketing than vertical SaaS companies. This is also helpful at time of exit. A sample of vertical, horizontal, and infrastructure SaaS companies that went public within the past decade showed that the median amount raised by a vertical SaaS company was $108M, $278M for horizontal SaaS, and $338M for infrastructure.

Embedded and Sticky → Typically vertical SaaS companies offer a workflow product as an initial wedge, and then add additional features like payments, CRM, communication, and revenue management. As customer engagement increases, data flywheels are created, allowing the SaaS company to continue providing a user experience that keeps customers engaged. These products help customers increase revenue, reduce operating costs, improve staff efficiency, streamline workflows, create personalized customer experiences, and make data-driven decisions with actionable insights about their customers.

Market Leadership → Vertical SaaS companies that reach scale typically need to be #1 or #2 in the market to reach $100M+ in ARR. Trading market size or share could lead to 50%+ market share penetration. To reach 50%+ market share penetration and $100M+ ARR, vertical SaaS companies must expand their product offerings to be multi-product and expand internationally to increase their market share. For example, Procore expanded its product offerings in 2018, three years prior to its IPO, and around the same time they reached $200M in revenue. nCino's first international expansion was to Europe in 2017. Quickly after, nCino expanded to Australia and Japan, and went public in 2020. One way to expand products and international reach is through strategic M&A once the company's primary workflow product has reached meaningful penetration in the company's original geographic market.

Lower Customer Count but High ACVs → In order to achieve a large percentage of the market and generate more than $100M ARR, vertical SaaS companies typically have a lower number of customers than horizontal SaaS companies, but higher ACVs at IPO. For example, Opower, Castlight, Demandware, Veeva, and Guidewire all went public with less than 400 customers. Some of them even had less than 200 customers, but their ACVs were mostly above $500K. One of these companies went public with an ACV of $1.1M or more.

Relentless Focus on the End User → While workflow and/or vertical-focused CRMs are necessary, it is the consumer product and mindset that truly set a vertical SaaS company apart. For example, Brightwheel recognized that parents wanted to communicate with their child care provider, leading them to create the category of child care software. Mindbody has a consumer-facing marketplace and booking system, but they sell the product to workout studios. FareHarbor provides free software and monetizes through an end-consumer transaction fee. Companies like Archy, which provides software for booking-focused businesses, often see success when they offer patient/consumer engagement features that help patients manage appointments, rebook appointments, pay online, fill out forms ahead of visiting, make follow-up purchases, patient referrals, and more.

IPOs aren’t the only option → While IPOs are great, there is a much higher volume of exits through PE or strategic M&A. Private equity firms find vertical SaaS companies attractive due to their capital efficiency, path to cash flows, repeatable playbooks, and low churn. Examples of successful exits include Mindbody's acquisition by Vista for $1.9B, Duck Creek Technologies' acquisition by Vista for $2.6B, Realpage's acquisition by Thoma Bravo for $10.2B, and Cerner's acquisition by Oracle for $28B.

What will shape the next generation of vertical SaaS?

Historically, platform shifts have led to new generations of vertical SaaS businesses. Servicetitan used the shift to cloud to win in a market typically manual and server-based, while Toast leveraged mobile to win in an industry dominated by NCR. We believe that AI is shaping the next generation of vertical SaaS winners, due to a handful of key factors:

Access and Availability of Proprietary Data → Vertical SaaS founders now have access to industry-relevant data from companies like Axel (trucking) and Rutter (commerce). There is also an abundance of software for managing data, creating opportunities for founders to build solutions around datasets that were previously difficult to access. The narrow, niche data that vertical SaaS companies can access is often proprietary to them, and can be used to train and finetune models that broad, horizontal LLMs like OpenAI or Anthropic can’t (or won’t), leading to…

AI-powered Systems of Intelligence → With increasing access to data, the next generation of vertical SaaS companies are primed to implement generative AI, using LLMs to parse through large amounts of text data and assist the user with an action.

We see three layers of defensibility for companies implementing intelligent systems of action: (i) Verticals have unique, proprietary data assets that general-purpose LLMs can't or won't have access to, uniquely positioning startups to create their own vertical-specific models. (ii) Given similarities across the customer base, the same models can be used across each customer, with individual finetuning done as needed, something horizontal models may struggle with (iii) As with any other product, the UX/UI and end-user experience matters greatly. Multiple products can be built on these models, and they need to have a wonderful user experience that is helpful to both the customer and the end consumer.

Increasing Digitization → In recent years, there has been a growing number of decision-makers who are technologically proficient and seek improved software solutions for their organizations. This trend has been driven in part by the rise of millennial decision-makers in the workforce, who have a greater inclination toward digitalization. As a result, purchasing decisions made by businesses increasingly reflect this demographic shift. Furthermore, the COVID-19 pandemic has accelerated the adoption of digital technology among workers, resulting in a greater level of comfort and a higher likelihood of embracing new software.

Embedded APIs → The pioneers of vertical SaaS in the early days had to make do without embedded fintech and automated marketing. Nowadays, startups can easily take advantage of Plaid, Twilio, and OpenAI to deliver more comprehensive products and services with greater speed. This enables vertical SaaS companies to swiftly broaden their product offerings and drive up their ACVs.

Applications of Large Language Models in vertical SaaS:

The next generation of vertical SaaS companies can win by owning the data layer and implementing the content layer in a variety of functionalities. We increasingly think that generative-native companies can win in spaces where a high degree of finetuning and multi-modality is involved. The more AI talent is heavily required, the harder it will be for incumbent vertical SaaS companies to compete with new generative-native companies. Verticals with a high dependency on security and accuracy likely require a greater degree of finetuning.

One example of a generative AI-native vertical SaaS company is Harvey, which is AI for lawyers. Security and accuracy are highly important in the legal vertical, and a large amount of text data exists (case files, settlement records, etc.). The company focuses on using LLMs trained on large volumes of case data and legal documents to act as a "Copilot" for lawyers, aiming to save lawyers time and money as a knowledge agent. Unlike the past decade of vertical SaaS companies that were centered around automating workflows, Harvey is centered around answering questions.

Looking forward:

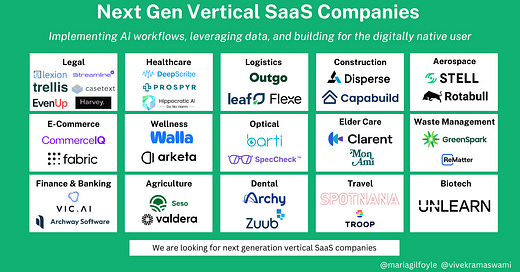

We are excited to meet founders building next-generation vertical SaaS companies. While LLMs can provide enhanced product experiences, generative-native vertical SaaS startups still need to provide value through a suite of products and a killer UX. We see continued opportunities for generative native vertical SaaS companies across healthcare, construction, ecommerce, insurance, real estate, finance, trucking, travel, and more. If you're a founder building a vertical SaaS company, we would love to meet you. Please reach out to vivek@madrona.com and maria@madrona.com. Thank you to our colleagues at Madrona for helping to shape our perspective on vertical SaaS.